By: Thomas K. Brueckner

One of the most accurate portrayals of the liquidity crisis surrounding the Subprime Housing Market Collapse of 2007 & 2008, was an HBO “docu-drama” entitled Too Big to Fail, the screenplay for which was derived from extensive interviews with each of the participants. These included Treasury Secretary Tim Geithner, Hank Paulson, Sheila Bair (the FDIC Chairwoman), and Fed chief Ben Bernanke, stoically played by Paul Giamatti. In the climactic scene, those four regulators are sitting on one side of a boardroom table across from the CEO’s of ten major banks and brokerage firms telling them—not asking them—that they’re about to be the recipients of a cash infusion from the Federal Reserve. “We don’t want your money”, reply several in unison, to which Ben Bernanke replied, “If you don’t take it, we won’t have an economy in 72 hours…” Bernanke went on to explain that credit and liquidity are the lubricants of every economy, and without them companies, countries, and governments fail. I encourage everyone to watch that film, as it’s far more than entertainment: it’s history accurately revealed and re-enacted.

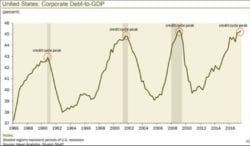

Those of you who have been reading these blogs over the years, know that four years ago I wrote dismissively of the gains that we were then experiencing on Wa ll Street as “…cotton candy on the tongue of a 5 year-old—no real nutritional value, resulting in nothing more than a sugar high…” As I explained then, corporate boardrooms were merely being opportunistic. They were using the ultra-low interest rate environment that the Federal Reserve maintained from 2009 forward, to offer competitive corporate bond yields to retirees, investors and fund managers, all of whom were desperate for something yielding more than 0.2%, the national average for a twelve-month CD at that time. Remember that when you are a stockholder, you are an owner of a corporation, but that when you are a bondholder you are a loaner to that corporation. A retiree giving a $100,000 loan in the form of a bond purchase to Corporation A, will receive a debt service or interest payment from that corporation each year, and (usually) ten years out have his principal returned to him—unless that corporation chooses to “roll over” that debt and renew it at then-current rates. As John Mauldin penned last week in his brilliant blog, “A Liquidity Crisis of Biblical Proportions is Upon Us”, and as the chart above shows, our corporate chickens will soon be coming home to roost, and covering our economic rooftop with an undesirable substance that pressure-washing cannot remedy.

ll Street as “…cotton candy on the tongue of a 5 year-old—no real nutritional value, resulting in nothing more than a sugar high…” As I explained then, corporate boardrooms were merely being opportunistic. They were using the ultra-low interest rate environment that the Federal Reserve maintained from 2009 forward, to offer competitive corporate bond yields to retirees, investors and fund managers, all of whom were desperate for something yielding more than 0.2%, the national average for a twelve-month CD at that time. Remember that when you are a stockholder, you are an owner of a corporation, but that when you are a bondholder you are a loaner to that corporation. A retiree giving a $100,000 loan in the form of a bond purchase to Corporation A, will receive a debt service or interest payment from that corporation each year, and (usually) ten years out have his principal returned to him—unless that corporation chooses to “roll over” that debt and renew it at then-current rates. As John Mauldin penned last week in his brilliant blog, “A Liquidity Crisis of Biblical Proportions is Upon Us”, and as the chart above shows, our corporate chickens will soon be coming home to roost, and covering our economic rooftop with an undesirable substance that pressure-washing cannot remedy.

Some of you have heard me on the radio in recent months proclaiming that our markets represent a justifiable rally of the last 18 months (built on sales, earnings and full employment), piled atop an unjustifiable rally of the prior six years. From 2011 forward, corporations borrowed cheap money from bondholders and—absent a profitable investment in the company or its future products amid a stagnant recovery—spent it on repurchased shares of their own stock instead. Shareholders didn’t care because this drove stock prices up, and with interest rates at historic lows, TINA (There is No Alternative) ruled the day. Since there was no money to be made anywhere else, even risk-averse retirees found themselves getting back into a market propped up by an accommodative Federal Reserve that had their back at every turn. Federal Open Market Committee meeting after FOMC meeting made a show of “the possibility” of a rate hike, yet month after month, year after year, none came. Investors grew complacent, and felt the party would never end. The day of reckoning for repayment of bond debt was many years off, and that debt could always just be rolled over rather than paid back.

Longtime clients who have attended a seminar or heard me on the radio in the past year know that John Hussman, notably the most accurate living economic forecaster in America today, has been predicting a two-thirds drop in the S&P 500 by the completion of the current economic cycle. The same algorithms he used to accurately predict the crashes of 2000-2002 and 2007-2009 are telling him that we are looking at a sell-off in excess of -62% at some point. Recently, he warned that markets can drop precipitously well ahead of a recession indicator, as is actually the norm. Enter John Mauldin a week ago: “…In an old style economic cycle, recessions triggered bear markets. Economic contraction slowed consumer spending, corporate earnings fell, and stock prices dropped. That’s not how it works when the Credit Cycle is in control.”

As the chart below shows, we are once again approaching a peak in the ratio of corporate debt to GDP, historically a signal of a credit cycle peak. Worse, the second component in this Perfect Storm is the amount of corporate debt that will be maturing this year, and over the next four years in particular. If the recession that Scott Minerd, Global CIO of Guggenheim Partners, believes will be upon us late next year arrives even as corporate debt is maturing, companies unable to rollover that debt amid then much higher rates, and equally unable to pay it back, would either default on  their bonds or contract considerably. “Companies that can’t service their debt have little choice but to shrink. They will do so via layoffs, by reducing inventory and investment, or selling assets.” According to Wells Fargo Securities, American corporations will need to refinance an estimated $4 trillion of corporate bonds over the next several years, roughly two-thirds of all their outstanding debt. Doing so amid even a mild recession, at a point soon after the Fed finishes “normalizing” interest rates by another 8 increases totaling an additional 2% above the 6 hikes already on the books, could lead to a market meltdown even worse than the Financial Crisis of 2007-2009.

their bonds or contract considerably. “Companies that can’t service their debt have little choice but to shrink. They will do so via layoffs, by reducing inventory and investment, or selling assets.” According to Wells Fargo Securities, American corporations will need to refinance an estimated $4 trillion of corporate bonds over the next several years, roughly two-thirds of all their outstanding debt. Doing so amid even a mild recession, at a point soon after the Fed finishes “normalizing” interest rates by another 8 increases totaling an additional 2% above the 6 hikes already on the books, could lead to a market meltdown even worse than the Financial Crisis of 2007-2009.

While we remain bullish for another 12-18 months amid a strong economy, full employment, robust GDP with no danger of overheating, and under-control inflation, all bets are off after that. Although still over a year away, the potential destructiveness of the storm that’s coming could prove to be the third and final -50% market selloff of the first 20 years of the new millennium. As John Hussman said when predicting a loss of up to two-thirds of the market’s value by the completion of this cycle, “My impression is that future generations will look back on this moment and say, ‘and this is where they completely lost their minds…’ ”

While one can hope that so many previously-correct analysts can be wrong about this one, the math is not in our favor. And hope is not a strategy.

Remember: One way to avoid both volatility and loss is by utilizing principal protection products—safe, simple, with reasonable rates of return. Call today! (800) 275-8137.